Investing in Individual Stocks: A Smart Approach

There are many ways to invest your money, from real estate to bonds, commodities, and mutual funds. But for many investors, the stock market remains one of the most accessible and attractive options. If you decide that investing in individual stocks is the right path for you, it’s essential to understand the most logical and affordable ways to do so. This guide will walk you through how to pick stocks wisely, why blue chip stocks can be a great starting point, what to expect from market fluctuations, and an alternative approach in index investing.

Choosing Individual Stocks Wisely

Investing in stocks means buying ownership in publicly traded companies. With thousands of stocks to choose from, it can be overwhelming to know where to start. Here are some key considerations:

- Understand the Business – Before investing in any company, ensure you understand what it does, how it makes money, and the industry it operates in.

- Review Financial Health – Strong companies typically have consistent revenue, manageable debt, and a history of profitability.

- Look at Valuation Metrics – Price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield can help you assess whether a stock is overvalued or undervalued.

- Assess Long-Term Potential – Investing in stocks is best done with a long-term mindset. Look for companies with strong leadership, innovation, and growth potential.

The Case for Blue Chip Stocks

One of the safest ways to begin investing in individual stocks is by focusing on blue chip companies. Blue chip stocks are shares of large, well-established companies with a long history of stability and profitability. Examples include Apple, Microsoft, Johnson & Johnson, and Coca-Cola.

Why Invest in Blue Chip Stocks?

Stability – Blue chip companies are typically less volatile than smaller, high-growth stocks.

Dividends – Many blue chip stocks pay consistent dividends, providing investors with regular income.

Strong Performance Over Time – While no investment is risk-free, blue chip stocks have historically recovered well from market downturns.

If you’re looking for reliability and steady returns, blue chips can be a solid foundation for your stock portfolio.

Market Dips and Recoveries: What to Expect

One thing every stock investor must understand is that the stock market goes through cycles. Corrections (a drop of 10% or more) and bear markets (a decline of 20% or more) are normal parts of investing. Here’s what you should know about market downturns:

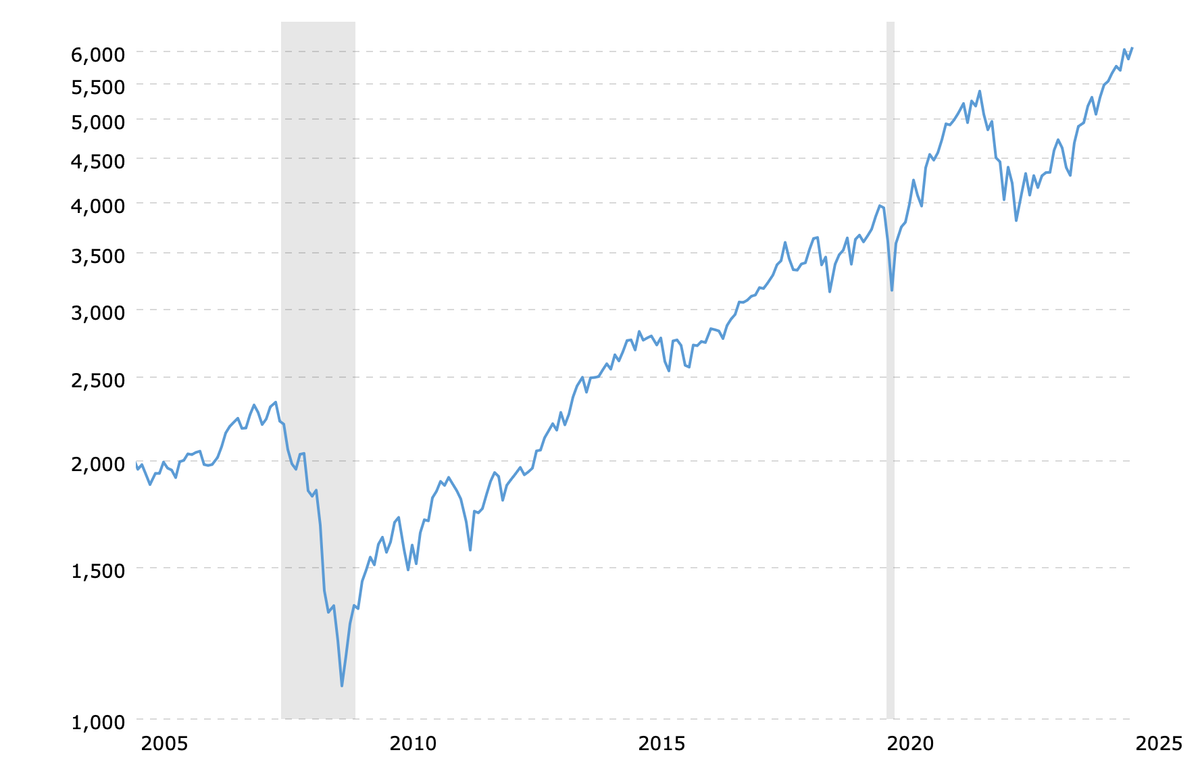

Dips Happen Regularly – Historically, the S&P 500 experiences a correction about once every two years.

Recoveries Are Common – Despite downturns, the market has always recovered over the long term. For example, after the 2008 financial crisis, the S&P 500 rebounded significantly, reaching new all-time highs within a few years.

Patience Pays Off – Selling in a panic can lock in losses, whereas staying invested allows you to benefit from rebounds.

The key to managing market volatility is to keep a long-term perspective and avoid making emotional decisions.

An Alternative Approach: Index Investing

If picking individual stocks seems too complex or time-consuming, another logical approach is investing in an S&P 500 index fund. An index fund is a type of investment that tracks the performance of a specific stock index, such as the S&P 500, which includes 500 of the largest U.S. companies.

Benefits of Index Investing

Diversification – By investing in an index fund, you’re spreading your investment across multiple companies, reducing risk.

Lower Fees – Index funds generally have lower management fees than actively managed funds.

Consistent Performance – The S&P 500 has historically delivered an average annual return of around 10% before inflation.

For many investors, index funds provide a simple and cost-effective way to gain exposure to the stock market without the need to research and select individual stocks.

Final Thoughts

Investing in individual stocks can be a rewarding way to build wealth, but it requires careful research, patience, and a solid understanding of market behavior. Blue chip stocks offer a great starting point for stability, while recognizing that market dips are a normal part of investing can help you stay on track. If picking stocks isn’t for you, index investing in an S&P 500 fund provides an excellent alternative. Regardless of your approach, staying informed and maintaining a long-term perspective will increase your chances of success in the stock market.

Recommended Reading

How to Analyze Stocks Before Investing

The Power of Dividend Investing

Understanding Market Corrections and Recoveries

Why Index Funds Outperform Most Investors

Common Mistakes to Avoid When Investing in Stocks