Financial Planning and Investing for Beginners

What is financial planning, and why is it important?

Financial planning is the process of setting financial goals, creating a strategy to achieve them, and managing your money effectively. It helps you prepare for short-term needs and long-term objectives like retirement or buying a home. Without a plan, it is easy to overspend, fall into debt, or miss out on investment opportunities. Financial planning also helps reduce financial stress by providing a clear roadmap for your future. It enables better decision-making when unexpected expenses arise and, over time, a solid plan can significantly improve your financial well-being. Even very seasoned investors can benefit from going back to the financial planning basics as a refresher. The importance of financial planning in our daily lives becomes more and more evident as we age, and adhering to simple money management tips can get you there.

How do I start investing with little money?

Starting with a small amount is possible through options like ETFs and index funds. Many apps allow you to invest with as little as $5, making it accessible to almost everyone. The key is consistency—invest regularly, even if the amount is small, to build wealth over time. Consider using automated investing platforms (robo-advisors) to simplify the process. Focus on low-cost investments to maximize returns. Reinvesting dividends can also accelerate your investment growth. Investing with little money is absolutely possible and it is so important to realize that everyone starts somewhere.

What’s the difference between stocks, ETFs, and mutual funds?

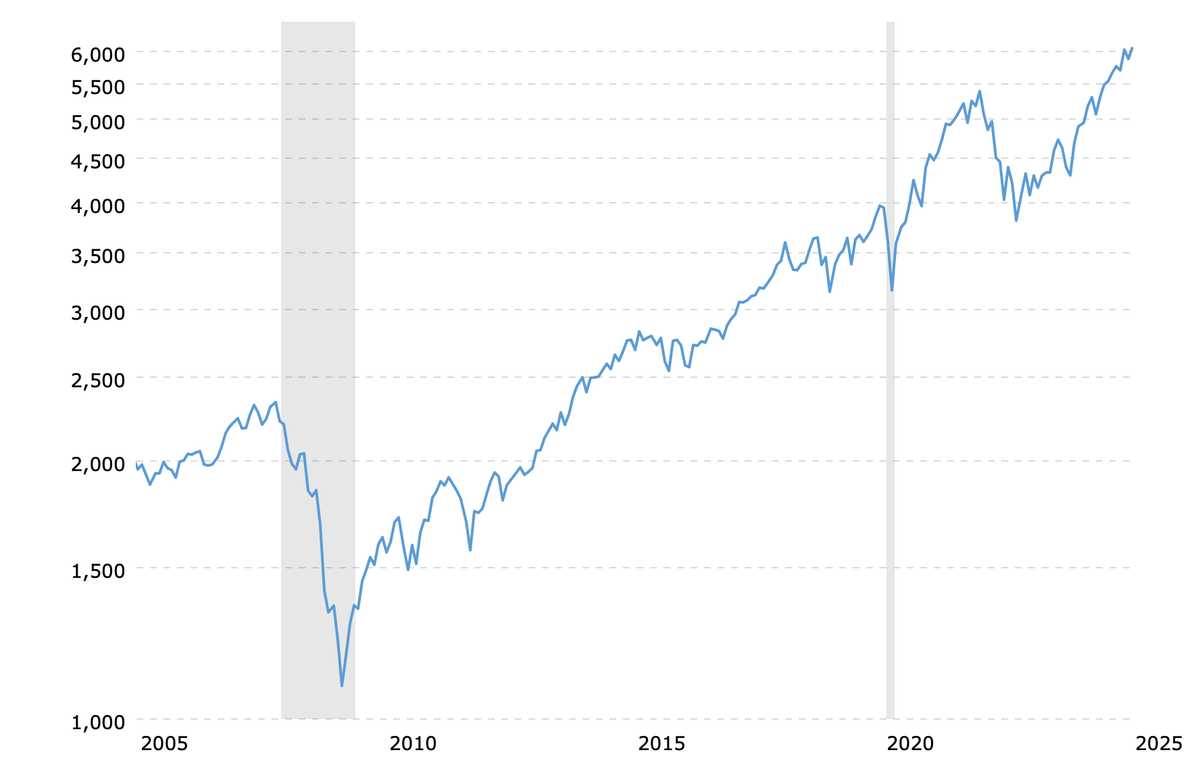

Stocks (also referred to as equities) represent ownership in a single company, while ETFs and mutual funds pool money from many investors to buy a diversified portfolio. ETFs trade like stocks on exchanges, whereas mutual funds are bought directly from the fund company. Understanding these differences helps you choose the right investment based on your goals and risk tolerance. Stocks can offer high returns but come with higher risk. ETFs provide diversification and often have lower fees compared to mutual funds. Mutual funds are actively managed, which can lead to higher costs but potentially better performance in certain markets. To reiterate, if you choose to buy individual stocks, you’re choosing a company like Apple, or JetBlue, to invest in. If you’d like invest in multiple companies at once, you would choose a pooled investment vehicle like an ETF or a mutual fund. A quick, simple way to get started is to purchase an ETF or mutual fund that invests in the S&P 500 since it provides instant diversification across 500 of the largest U.S. companies, minimizing individual stock risk while offereing long-term growth potential. This approach is considered passive, requires little maintenance, and is a great way for investors to participate in the stock market without needing to pick individual stocks. Some of the most popular index funds that track the S&P 500 include:

Exchange-Traded Funds (ETFs) SPDR S&P 500 ETF Trust (SPY) iShares Core S&P 500 ETF (IVV) Vanguard S&P 500 ETF (VOO)

Mutual Funds Vanguard 500 Index Fund (VFIAX) Fidelity 500 Index Fund (FXAIX) Schwab S&P 500 Index Fund (SWPPX)

Beginner Tip! These funds are all great for broad market exposure with low fees. Easy, inexpensive, effective!

How much should I save before I start investing?

It's generally recommended to have an emergency fund covering 6 months of expenses before investing. This ensures you're financially secure if unexpected costs arise. A beginner investor tip is to ask yourself, “If I lost my job tomorrow, how long would it actually take for me to realistically get something new?” The idea is to have enough cash saved in your emergency fund to cover all expenses until you replace your income. Without this emergency reserve in place, you’ll be forced to sell your investments to pay bills and that is what you want to avoid. Once your savings are in place, you can confidently start investing without worrying about dipping into your investments during tough times. Additionally, before investing, it is smart to pay off any debts, as the interest can outweigh potential investment gains. Start with manageable amounts to build your confidence. As your financial situation improves, gradually increase your investment contributions.

What is risk tolerance, and how do I determine mine?

Risk tolerance is your ability to handle market fluctuations without panic-selling investments. Risk tolerance is about how you feel during the times when your portfolio drops in value. Remember, it doesn’t always just go up, there will be times when your balance will decrease, and your risk tolerance has to do with how you react in those moments. It depends on factors like your financial goals, investment timeline, and emotional comfort with risk. You can determine yours through online questionnaires or by reflecting on how you'd react to market ups and downs. Consider your past financial decisions to gauge your comfort level. Reassess your risk tolerance periodically as your life circumstances change. Balancing your portfolio can help manage risk according to your tolerance. Understanding investment risk and the beginner investing psychology is crucial to managing your own expectations and having a successful outcome. Try to think of investing as a long-term situation—it is less important how your investments perform over the next 6 months, or 2 years, and it is more important to focus on long-term growth. Do not invest to get rich quick, invest to prepare your future over time. It is a slow process that improves with a disciplined, thoughtful, and structured approach.

Recommended Reading

- Forbes "12 Essential Tips Every Beginner Should Know About Investing"

- Wall Street Journal "Why 'Pay Yourself First' Is the Best Kind of Budget"

- Wall Street Journal "A Guide to Financial Planning"

- GQ "The GQ Guide to Money: How to Make It, Save It, Grow It, and Spend It"

- The Economist "Guide to Investment Strategy"